what is maryland earned income credit

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. 36 rows States and Local Governments with Earned Income Tax Credit.

Tax Credits Deductions And Subtractions

6728 if you have three or more qualifying children.

. How Much Is The Earned Income Credit In Maryland. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. The maximum Earned Income Tax Credit amounts for the 2021 tax yearthe return youd file in 2022are as follows.

Married employees or employees with qualifying children may qualify for up to half of. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. This is available for the 2021 tax year dependent on your adjusted gross income AGI.

Employees who are eligible for the federal credit are eligible for the Maryland credit. The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial assistance to low-income working families. The maximum federal credit is 6728.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. Answer some questions to see if you qualify.

Federal Earned Income Tax Credit. Income limits vary depending on your filing status AGI and the. If you qualify you can use the credit to reduce the taxes you owe.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. R allowed the bill to take effect without his signature.

Does Maryland offer a state Earned Income Tax Credit. State or Local Government Percentage of Federal Credit Is Credit Refundable. By Angie Bell August 15 2022 August 15 2022 The maximum federal EITC amount you can claim on your 2021 tax.

If you qualify for the federal earned income tax credit and. However the amount of the credit is figured based on family. If you qualify for the federal earned income tax credit and.

The maximum credit for the 2020 tax year is 6660 and the maximum income to qualify for any credit is 56844. Earned Income Tax Credit EITC. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

Earned income tax credits EITC are a common strategy used by governments.

Mdhs Advises Eligible Marylanders To Utilize The Earned Income Tax Credit The Baynet

Federal Earned Income Tax Credit Expansion Would Help Maryland S Workers And Economy Maryland Center On Economic Policy

Summary Of Eitc Letters Notices H R Block

United Way Of Chester County Joins United Way Of Pa In Call For Pa Tax Relief United Way Of Chester County

Maryland S Earned Income Tax Credit Proposal 3 16 98

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Introduction To Tax Law Part 6 Earned Income Credit 2022 Youtube

Maryland Volunteer Lawyers Service Eitc Can Give Qualifying Workers With Low To Moderate Income A Substantial Financial Boost To Receive The Credit People Must Meet Certain Requirements Use The Irs Eitc Assistant To Check

Why We Should Expand The Earned Income Tax Credit Prosperity Now

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

Eligibility Rules Maryland Department Of Human Services

News Release Comptroller Franchot Senator Zucker Delegate Rosenberg And Advocates Hail Expansion Of Low Income Taxpayer Law Clinics

Expanding The Maryland Earned Income Tax Credit Eitc Sign On Survey

Economic Relief Megan Bautista Cash S Program Associate For Tax Partnerships Provides An Overview Of The Tax Provisions Of Recent Federal And Md State Legislation By The Cash Campaign Of Maryland Facebook

Louisiana Update April 2021 All In One Poster Company

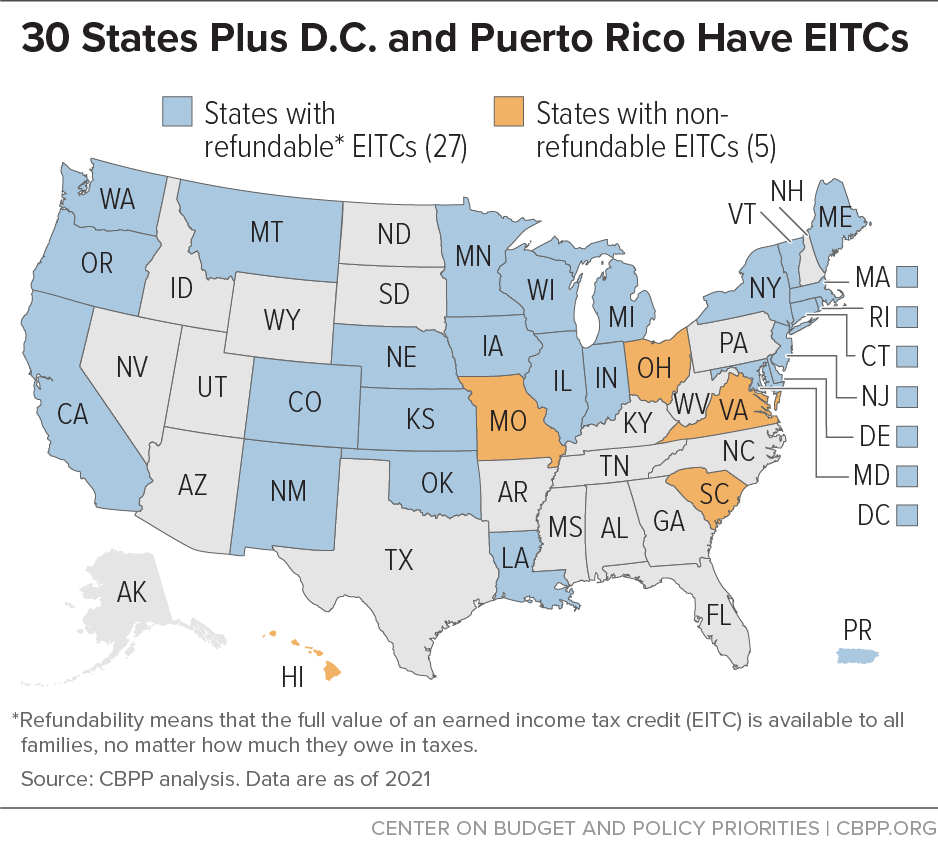

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Policy Basics State Earned Income Tax Credits Center On Budget And Policy Priorities