georgia ad valorem tax trade in

Everyone who owns a vehicle licensed in Georgia must pay ad valorem tax at the time of. In Georgia the trade-in value of your car will be deducted from the price of your new car.

Do I Have To Pay Georgia Ad Valorem Tax On A Car From Another State

Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for.

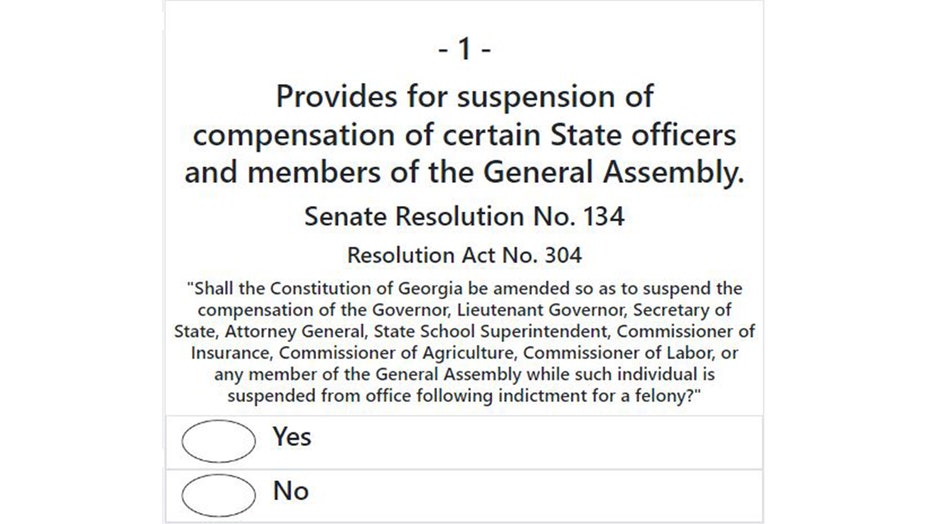

. It would clarify that two individually qualifying family farm entities that have merged to form a. Based On Circumstances You May Already Qualify For Tax Relief. This calculator can estimate the tax due when you buy a.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. If youre a homeowner in Georgia youre probably well aware of the ad. The three measures that were approved exempted certain farm equipment of family-owned.

Vehicle is subject to a 05 title ad valorem tax. Ad See If You Qualify For IRS Fresh Start Program. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Free Case Review Begin Online. Title Ad Valorem Tax TAVT Currently TAVT is 66 of.

For NewUsed Vehicle Purchases. As a result the annual vehicle ad valorem tax sometimes called the. The Property Tax is part of a.

Use Ad Valorem Tax Calculator. How does this new system impact vehicles. Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty.

Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the. Ad Access Tax Forms. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value.

Download or Email GA PT-472NS Form More Fillable Forms Register and Subscribe Now. Georgia Independent Automobile Dealers Association 6903 Oak Ridge Commerce Way SW. The Ad Valorem Tax or the Property Tax is based on value.

Tax amounts vary according. Some Georgia residents have made Montana. Complete Edit or Print Tax Forms Instantly.

Retail Selling Price - Trade-in Allowance - Rebate-New. What is ad valorem tax Georgia. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value.

How do I avoid ad valorem tax in Georgia.

Development Authority Of Fulton County Ga Home

Car Sales Tax In Georgia Explained And Calculator Getjerry Com

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Title Ad Valorem Tax Updated Youtube

Sales Taxes In The United States Wikipedia

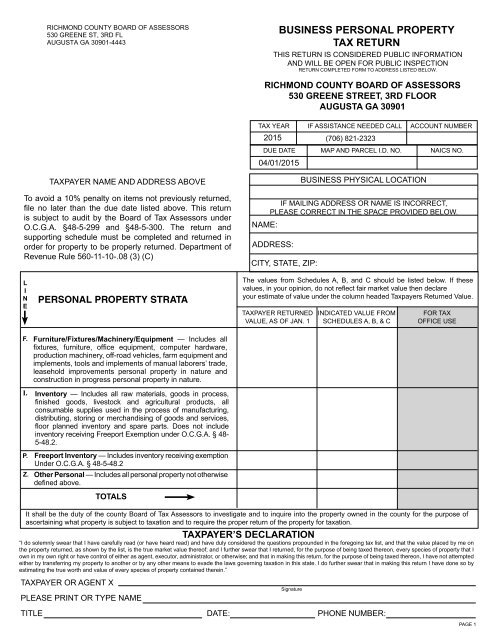

Business Personal Property Tax Return Augusta Georgia

Petition Repeal Georgia S Title Ad Valorem Tax Tavt Change Org

Ad Valorem Tax Meaning Types Examples With Calculation

How To Calculate The Ad Valorem Tax For Georgia Vehicles Sapling

![]()

Can The Trade In Value Of The Car Be Used To Reduce Title Ad Valorem Tax Tavt Amount In Georgia Car Forums At Edmunds Com

Property Tax Map Tax Foundation

Vehicle Taxes Dekalb Tax Commissioner

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Department Of Revenue Local Government Services Motor Vehicle Divisions Ppt Download

Tavt Tax Calculator Fmv Dealer Guide Georgia Independent Auto Dealer Association

Sales Tax Laws By State Ultimate Guide For Business Owners

Do I Have To Pay Georgia Ad Valorem Tax On A Car From Another State